Simple payback period formula

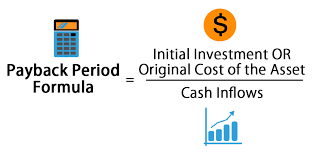

Simple payback method calculates the length of time within which the future cash inflows of a project can recover its initial cost. Written out as a formula the payback period calculation could also look like this.

Summary Of Payback Period Abstract

The payback formula is simple.

. For example if you spent 100 on a capital asset that generates 10 each year it. It can get a bit tricky when annual net cash flow is expected to vary from year to. The discounted payback period.

- ln 1 -. Ln 1 discount rate The following is an example. Retrieve Last Negative Cash Flow.

The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows. Input Data in Excel. Investment Annual Net Cash Flow From Asset.

Payback Period Initial Investment Annual Payback. The formula for discounted payback period is. The payback period is the total investment required to purchase the asset or fund the project divided by the net annual cash flow which is.

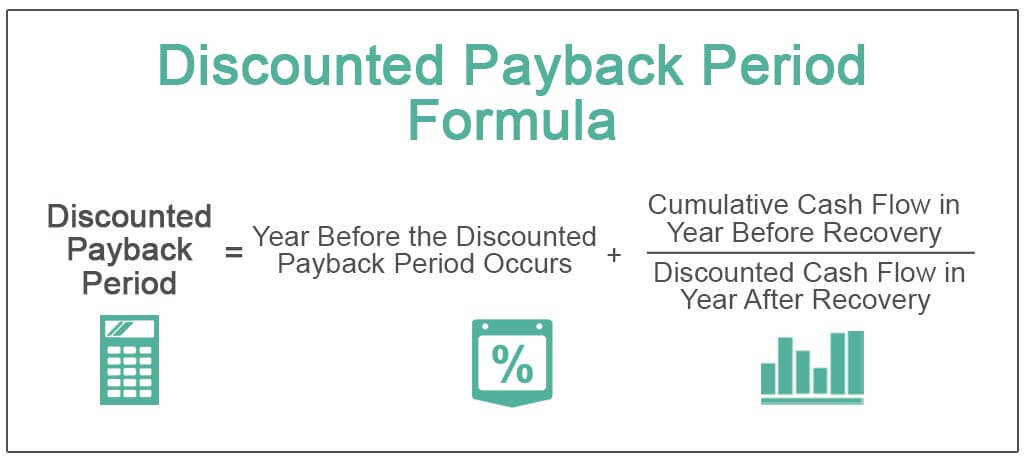

Calculate Net Cash Flow. The payback period formula is pretty simple assuming the income generated from the project is constant. Discounted Payback Period Year before the discounted payback period occurs Cumulative cash flow in year before.

The payback period is expressed in years and fractions of years. Use the PMP exam formula below to calculate the payback period of a project. However the discounted payback period would look at each of those 1000.

The payback period is the time it takes to recover the cash outflows on an initial capital investment. Discounted Payback Period. Find Cash Flow in Next Year.

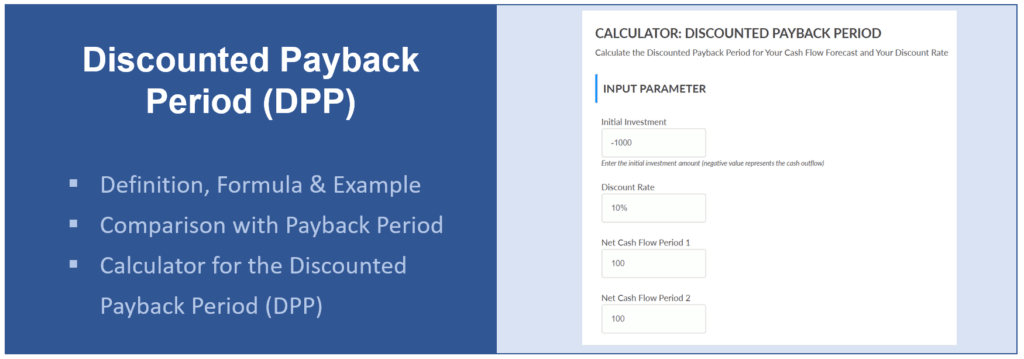

Cash flow per year. For example if a company invests 300000 in a new production line and the production line then produces. Now we will calculate the cumulative discounted cash flows.

The payback period calculation is simple. As you can see using this payback period calculator you a. The simple payback period formula would be 5 years the initial investment divided by the cash flow each period.

Investment amount discount rate. The discounted payback period formula is the same as that simple payback period method explained in a different post apart from one thing. For example imagine a company invests 200000 in.

Payback Period Formula And Calculator

Calculate The Payback Period With This Formula

How To Calculate The Payback Period With Excel

Payback Period Formula And Calculator

How To Calculate The Payback Period With Excel

Discounted Payback Period Example 1 Youtube

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Undiscounted Payback Period Discounted Payback Period

Payback Period Method Double Entry Bookkeeping

B Simple Payback Vs Roi Youtube

Discounted Payback Period Meaning Formula How To Calculate

What Is Payback Period Formula Calculation Example

Payback Period Formula And Calculator

Payback Period Method Commercestudyguide

Payback Period Business Tutor2u

How To Calculate The Payback Period With Excel

Discounted Payback Period Definition Formula Example Calculator Project Management Info